California is losing cargo and high paying jobs to ports throughout North America. And at this point, it isn’t doing much about it.

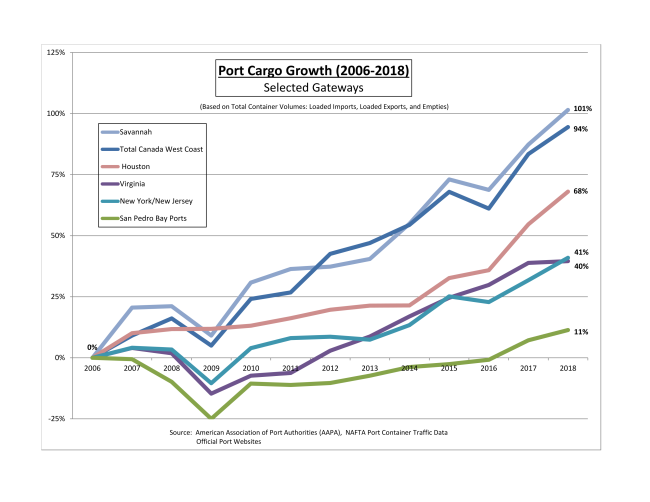

Growth at Southern California ports over the past twelve years are at rates far below the competition. The disparity is found in data from the American Association of Port Authorities (AAPA) from 2006-2018. It shows a disturbing trend.

What are the implications for Californians when cargo bound for the Midwest goes through Virginia, Georgia or Texas? With more than one out of seven Southern California jobs tied to logistics, the loss of market share means the loss of high-quality logistics jobs that stretch from California ports to the boundaries of the state.

How has this competitive disadvantage become so significant? What should California execute to reverse the trend?

The reason for our declining market share is complex and multi-faceted. Over the years California ports have experienced the following:

- Lengthy, litigious and tortuous environmental planning and permitting.

- Waterfront labor disruptions.

- Opening of a wider Panama Canal that services larger vessels.

- Development of additional North American trade gateways in time frames that are measured in years, not decades as is experienced in California.

- Aggressive marketing by other states – and the lack thereof in California.

- The assessment of a federal Harbor Maintenance Tax (HMT), which is not assessed on cargo moving through Canadian or Mexican ports – and adding insult to injury, the HMT money collected at California ports is allocated by Congress to fund projects at US ports who are our competitors, in essence converting small boutique ports into larger competitors.

- Service and pricing competition with Canadian railways which makes Canadian ports more attractive.

Not acknowledged, or certainly not publicly discussed are other factors. We suffer from:

- Arrogance – with a belief that the cargo HAS to come through California – and under that attitude, no fee is too large, no operational mandate too costly; no regulatory measure too burdensome;

- Costs – marine terminal leases at Southern California ports are in many cases two to three times more expensive on a per acre basis as compared to terminal costs in other parts of the country

- The cumulative impact of environmental regulations. One example is the Ports of Los Angeles/Long Beach’s Clean Air Action Plan, which will require zero emission technology and emission reductions decades ahead of current state goals and regulations and is estimated to cost approximately $14 billion.

It should be noted that California’s marine terminals are utilizing or experimenting with near zero or zero emission electric battery and hydrogen technologies. Port trucks are the cleanest, not just in California but in the United States. Vessel operators are slowing down and utilizing low sulfur fuels and shore side power. The result is a dramatic reduction of all categories of pollutants and green-house gas emissions. All of that is a good story – but these regulatory expenses are not incurred by our competition and there is no offsetting funding or marketing program offered by the State to counter or mitigate this cost burden.

California can address the loss of jobs and market share by taking actions toward solutions that will attract cargo and promote the logistics industry. Here are some initial recommendations:

- First, we need to engage in a calm, rational and honest discussion about the challenges that we face. This would involve all players including public policy officials, supply chain interests, environmental and community groups and labor. Until we have the intellectual honesty to admit that the goods movement industry is valued and provides hundreds of thousands of jobs across the state, we will continue to chase freight away.

- Second, we need to acknowledge that policies involving billions of dollars of infrastructure investment will need to be economically feasible and not simply politically popular.

- Third, we need to change the fundamental way we do business as opposed to looking for ways that utilize the same technologies, the same roles, the same business practices but yet expect a different result. The goods movement industry is evolving. Is California prepared to embrace this change?

- Fourth, politicians and regulators cannot be picking winners and losers. If the playing field does not remain an open market, freight will be diverted.

- Finally, we need to remember that freight will flow along the path of least resistance.

California ports offer a premier product. But as long as we are impacted by cost, uncertainty and infighting, our success in a very competitive marketplace is not guaranteed. Our past success is eroding and fading away. The time for action is now.

Fox & Hounds Daily

By John R. McLaurin, President of the Pacific Merchant Shipping Association