Ship Traffic Trends Amidst Trade Uncertainty

By Capt. Mike Moore, Vice President of PMSA

Ports often assess performance by tracking cargo volume growth. While additional metrics exist, cargo reigns supreme. Container ports measure activity in terms of twenty-foot equivalent units (TEUs), categorized by imports, exports, and empties in both domestic and international trade. Other ports focus on total tonnage, segmented by commodity types.

Another key indicator — though often overlooked — is ship traffic, defined by the number of port calls. While ship traffic is just one piece of the broader supply chain, it supports numerous jobs: ship agents, tug operators, line handlers, pilots, fuel suppliers, maritime technicians, oil spill response organizations, marine exchanges, and trade associations. Ship arrivals also require services from agencies like the US Coast Guard and Customs and Border Protection.

Ship traffic figures frequently spark public policy debate, especially around safety and environmental concerns.

In one narrative, there's a recurring claim that air emissions or other impacts from ships are rapidly increasing because of increases in ship traffic — but the data tells a different story.

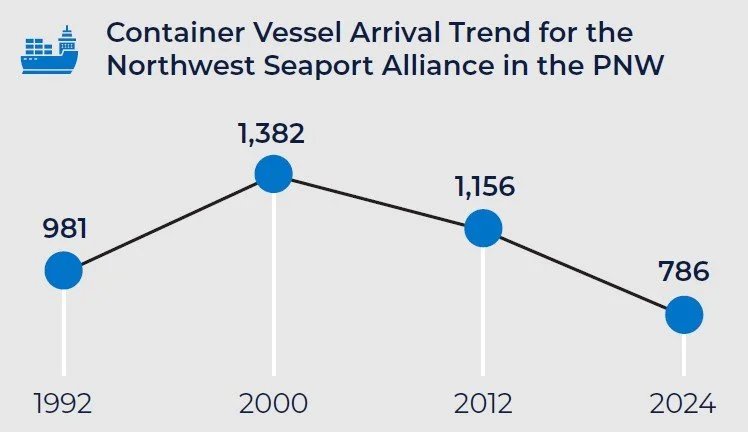

In Puget Sound, for example, cargo ship arrivals peaked at 3,247 in 1992, when no cruise ships were calling. Last year, cruise ships made 277 calls, yet cargo ship arrivals declined to 2,209—including 638 tanker and articulated tug/barge calls related to northern Puget Sound refineries. That’s a decrease of more than thousand dry cargo ship calls over three decades. Similarly, container ship arrivals in the Pacific Northwest peaked at 1,382 twenty-five years ago but fell to 786 last year.

What’s driving the downward trend in the PNW? The shift stems in part from increased use of more-efficient, newer, and larger container ships which are transporting more containers per visit. In other sectors, some vessels — like log carriers — have nearly vanished. Bulker arrivals that included log carriers, for instance, fell from 1,119 in 1992 to just 279 last year. Each port has its own story, but a consistent trend is clear: fewer ship calls are needed to manage rising cargo volumes especially in the container sector.

On the other hand, the discussions over tariffs and current trade dynamics have resulted in the opposite assertion – that ship traffic is deteriorating. Earlier this year, some predicted a decline of over 35% in ship calls at the San Pedro Bay port complex. Fortunately, that scenario has not materialized. Despite ongoing uncertainty, overall container volumes so far this year have exceeded expectations, outpacing 2024. The Port of Los Angeles set records in June as businesses strategically manage inventories to prepare for multiple potential outcomes later this year. But the ship traffic metric tells a more tempered story: year-to-date, the West Coast (Los Angeles, Long Beach, Oakland and NWSA)—is seeing nearly 11 container ship arrivals per day, which aligns with historic norms.

Of course there is turbulence ahead, especially surrounding the end of cargo spikes tied to looming tariff decisions. While discussions surrounding tariffs frequently cite container volumes between the U.S. and trading partners—especially China – key questions remain about how U.S. imports will be affected by onshoring, changes in origin countries, or material substitution. Daily discourse includes concerns about inflation and the degree to which tariffs will be absorbed across the supply chain, potentially minimizing consumer impacts.

Projecting long-term ship traffic impacts remains challenging, but trade data offers some clues. Optimists point to continued global growth in container trade, which includes the U.S. as a key participant. While onshoring and tariffs may shift some trade patterns, they are unlikely to permanently suppress overall cargo volumes.

How that volume will translate into ship traffic patterns is yet to be seen. What we do know to expect are changes in voyage strategies, port rotations, and rising average container vessel size as indicated by the trends and current order book of new ship builds. While the timing of how and when all of this plays out remains uncertain, if the past is prologue, at least the trajectory is clear — we will ultimately see more cargo and fewer, bigger ships in the container sector.