The USWC’s Diminishing China Export Trade

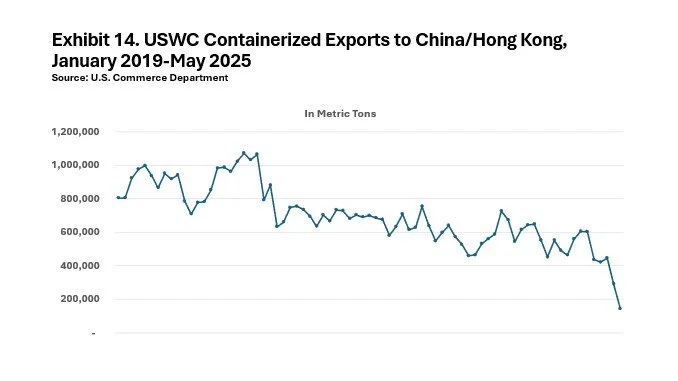

Through the first five months of 2025, containerized export tonnage from U.S. West Coast ports to China and Hong Kong plunged by 42.1% from the same period a year earlier and by 61.4% from the same months in 2019. Of the ten leading export commodities USWC ports shipped to China/Hong Kong, all showed very substantial double-digit declines. In the case of Waste and Scrap Paper, a commodity that accounted for 41.2% of all containerized tonnage shipped to China and Hong Kong from USWC ports in the first five months of 2019, this year’s YTD share of the trade amounted to a mere 0.9%. Similarly, exports of tree nuts to China/Hong Kong so far this year are down by 83.0% from the same period six years ago.

Over at the Almond Board of California, records show that almond exports to China/Hong Kong during the current crop year (August 1, 2024, through May 30, 2025) have been down 51.4% to 48,486,601 pounds from 99,701,657 pounds. The California Walnut Board reports that inshell walnut shipments to China/Hong Kong In their current crop year (September 1, 2024, through May 30, 2025) were up 32.7%, but the much larger trade in walnut kernels fell by 30.4% to 6,066,899 pounds from 8,718,223 pounds a crop year earlier. Meanwhile, pistachios, which share the same crop year as walnuts, saw exports to China/Hong Kong all but collapse to 1,328,000 pounds from 8,708,447 pounds.

There seems to be a near universal understanding that tariffs have played some role in these trends.