2025 Avocado, Nuts, and Wine Trade Volumes

Exporting Avocados

Mexico is by far the largest source of avocados imported into the United States. Last year, our southern neighbor supplied 90.7% or $3.418 billion of the $3.768 billion avocado import trade. Through the first three quarters of this year, that share has slipped to 86.1% as shipments from Peru, Colombia, and Chile soared.

Not surprisingly, most of the imports from Mexico arrive via overland routes, with two Ports of Entry in Texas, Hildago and Laredo, accounting for the bulk of the traffic, 81.9% last year and 84.3% so far this year. Waterborne imports in 2024 mostly arrived at the neighboring ports in Pennsylvania, Philadelphia (PhilaPort) and Chester. Those two Ports of Entry accounted for $193.5 million in avocado imports last year and $212.3 million through the first three quarters of this year.

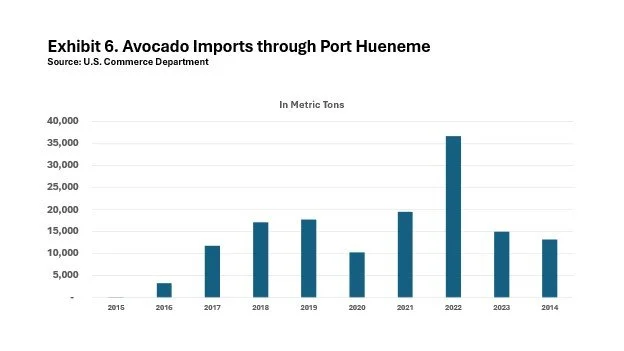

On the West Coast, Port Hueneme dominates the oceanborne import trade with volumes that easily dwarf the avocado import trade moving through all other West Coast ports combined.

The Latest Tree Nut Exports

Although federal statisticians are striving to catch up with the nation’s trade values and volumes, industry groups have been able to fill in some of the gaps. For example, October figures from the Almond Board of California show that exports in the current crop year, which began on August 1, have been up just 0.7% from a year ago. Meanwhile, the California Walnut Board is reporting shipments abroad of inshell walnuts are up 22.6% from a year earlier, but exports of walnut kernels rose only 2.6%. As for pistachios, the October report from the Administrative Committee for Pistachios shows a 26.5% bump in exports so far this crop year.

All three nuts continue to be produced largely for foreign customers. 77.6% of the pistachios shipped in the current crop year went abroad, as did 75.8% of almonds and 94.8% of walnuts.

Exporters of all three nuts have been severely impaired by the trade disputes between the United Stated and China. Through the months of September and October, zero walnuts were shipped directly to China, although Hong Kong did receive an unusually large volume of walnut kernels. The almond export trade with China has been down 75.1%, while exports of pistachios to China and Hong Kong are down by 34.2% so far this crop year.

Bulk Wine Shipments More Than Holding Up

Global wine consumption continues to decline, but the bulk wine category is emerging as one of the few resilient segments of the market, according to official U.S. trade statistics for the first three quarters of this year. Import tonnage showed a relatively robust 15.9% increase to 204,186 metric tons, while export tonnage rose 13.8% to 82,342 metric tons.

Containerized bulk wine imports through the Port of Oakland jumped 16.5% over the first three quarters of last year as the Northern California maritime gateway accounted for 92.4% of all bulk wine imported through U.S. mainland ports. Given its proximity to California’s wine producing regions, Oakland not surprisingly also handled 97.9% of all bulk wine exports shipped via the country’s seaports.

According to figures presented at the World Bulk Wine Exhibition earlier this month, 2024 saw the lowest global production of wine since 1961. Consumption fell across most major market categories. However, bulk wine continues to thrive and now represents an estimated 34% of global export volumes, albeit by just 7% of export value.