The Declining China Trade

Tariffs have consequences. A decade ago, in 2015, China accounted for 35.8% of all containerized import tonnage discharged at ports on the U.S. mainland. By last year, that share had declined to 26.7%.

The effects of the deteriorating trade relations between Washington and Beijing have been especially apparent along the U.S. West Coast.

Exhibit 6 displays China’s share of all containerized imports that arrived at the five major U.S. West Coast port complexes between 2015 (effectively the last two year of Barrack Obama’s presidency) and 2025. In 2015, China accounted for 60.1% of all containerized import tonnage arriving at the Ports of Los Angeles and Long Beach, 56.2% at the Northwest Seaport Alliance Ports of Tacoma and Seattle, and a relatively modest 40.0% of the inbound container tonnage handled at the Port of Oakland. By last year, those shares had shriveled to 47.5% at the Southern California gateway, 39.8% at the NWSA ports, and 29.5% at Oakland.

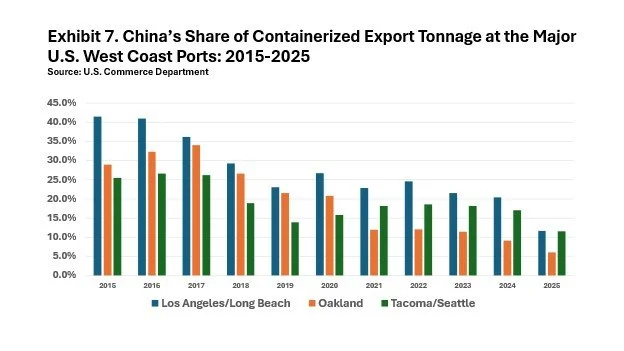

Nationally, China was on the receiving end of 22.5% of all containerized export tonnage shipped from mainland U.S. ports. By last year, just 8.5% of the nation’s outbound containerized tonnage went to China. Exhibit 7 traces the parallel slide in China’s share of the containerized tonnage exported from the primary USWC marine gateways. It is difficult not to note that the nation’s export trade with China has been significantly more affected by the bilateral trade disputes of the past decade than the more resilient import numbers that indicate that the U.S. remains much more reliant on imported merchandise from China than China has been on American goods.