Is the USWC Marketshare of U.S. Container Trade Winding Down?

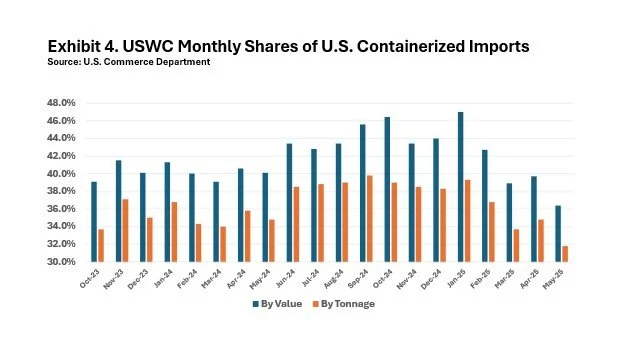

As Exhibit 4 reveals, the past year has witnessed major shifts in coastal shares of America’s inbound container traffic. Back in October 2023, attacks on vessels off the coast of Yemen in the Red Sea nudged more U.S.-bound containerized cargo to Pacific Coast ports. Then, by early last summer, the prospect that America’s East and Gulf Coast ports might be closed by a longshore strike or lockout prompted shippers to redirect traffic away from the threatened ports. As a result, the USWC marketshare of all U.S. inbound container tonnage rose sharply in 2024. However, 2025 has seen this share slide decidedly from 39.3% in January to 31.8% in May, which was the USWC’s second lowest share ever. Only February 2023’s 31.0% share has been lower. May’s 36.4% share of the declared value of inbound containerized shipments similarly plumbed the bottom, with only the 36.0% share recorded in November 2022 dipping lower.

Exhibit 5 illustrates a parallel experience with containerized imports from East Asia. In January, USWC ports handled 67.1% of the value of containerized imports from East Asia and a 57.4% tonnage share. By May, those shares had fallen to 58.9% and 49.9%, respectively.

Although the restoration of labor-management harmony at ports from Maine to Texas will permit East and Gulf Coast ports to continue their efforts to erode the share of America’s container trade moving through West Coast ports, the recent renewal of brazen assaults on Red Sea shipping will likely continue to disrupt global shipping patterns for the near future.